Roth 401k paycheck calculator

Released this week the poll tracks what economists call the reservation wage the lowest paycheck a person is willing to accept for a new job. A compilation of free financial calculators involving mortgages loans investments debt retirement and more each with related in-depth information.

Debt Payment Tracker Printable Debt Tracker Printable Debt Etsy In 2022 Budget Planner Printable Debt Tracker Money Planner

A Roth 401k is an employer-sponsored retirement plan thats funded by after-tax dollars.

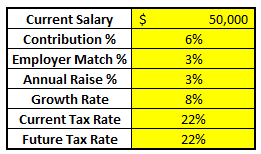

. A 401k can be an effective retirement tool. That means once you turn 59 12 you can withdraw money from your account and you wont owe a penny in taxes. Use this calculator to help decide whether you should invest in a Traditional or Roth 401K.

Traditional IRA vs Roth IRA. The 401ks annual contribution limit of 20500 in 2022 27000 for those age 50 or older. A 457b retirement plan is much like a 401k or 403b plan.

Like a traditional 401k the Roth 401k is a type of retirement savings plan employers offer their employeeswith one big difference. Named for Delaware Senator William Roth and established by the Taxpayer Relief Act of 1997 a Roth IRA is an individual retirement plan a type of qualified retirement plan that bears. As an example we will enter 100000 as the account balance.

Contribute to your 401k. A 457b plan is offered through your employer and contributions are taken from your paycheck on a pre-tax basis which lowers your taxable income. These accounts come in traditional and Roth variations with each having their own tax benefits according to IRS tax laws.

Related Retirement Calculator Roth IRA Calculator Annuity Payout Calculator. A close cousin of the traditional 401k the Roth 401k takes the tax treatment of a Roth IRA and applies it to your workplace plan. Employers offer 403b and 401k plans to help their employees save for retirement but chances are you wont have to choose between them.

If your employer offers a 401k plan consider contributing pre-tax money with every paycheck. Because 401ks are integrated through an employer you can easily contribute to your 401k account directly through your paycheck. It shares certain similarities with a traditional 401k and a Roth IRA although there are important.

The Roth 401k brings together the best of a 401k and the much-loved Roth IRA. Some employers even offer contribution matching. Here are some advantages a Roth IRA has over a 401k.

Nerdwallet provides a great basic 401k contributions calculator that lets you play with different contributions and matching amounts. Add a Free 4-20 Ma Calculator Widget to Your Site. Try to meet or exceed their matching amount to make the most of your retirement savings.

Roth 401k contributions are made after taxes have been taken out of your paycheck. Traditional 401k and your Paycheck. While valuable a 401k should only be a part of your overall retirement savings plan.

US Paycheck Tax Calculator. It is named after subsection 401k in the Internal Revenue Code which was made possible by the Revenue Act of 1978. A set percentage the employee chooses is automatically taken out of each paycheck and invested in a 401k account.

But if you want to know the exact formula for calculating 4-20 ma then please check out the Formula box above. A 401k is a form of retirement savings plan in the US. For this example we will enter 72 as the age.

When you hear the word Roth your ears should automatically perk upbecause a Roth IRA allows your savings to grow tax-free. Long Term Disability Insurance Life Insurance. The calculator also asks you what your age was at the end of the last calendar year.

As of 2020 the 401k contribution limit for those aged 50 and below is 19500. This 401k distribution calculator is very simple and all it asks is that you enter your account balance at the end of the last year. The reason to use one of these accounts instead of an account taking pre-tax money is that the money in a Roth IRA or Roth 401k grows tax-free and you dont have to pay income taxes when you withdraw it since you.

Once you have 250000 or more in total plan value add up all your assets and cash in the plan you will file form 5500-EZ. 401k Save the Max Calculator. Advantages of a Roth IRA.

The Solo 401k is a retirement account and is tax-deferred therefore there is no tax return due for a Solo 401k plan. These two tax-advantaged retirement plans are designed. Contributions come out of your paycheck after taxes but.

Roth IRAs are only available to people making less than 129000 a year as an individual. With tax benefits that are mainly available through an employer. Effective Rate Calculator.

That way the money you put into your Roth 401k grows tax-free and youll receive tax-free withdrawals when you retire. A Roth 401k allows you to contribute on an after-tax basis. Lets be honest - sometimes the best 4-20 ma calculator is the one that is easy to use and doesnt require us to even know what the 4-20 ma formula is in the first place.

As of January 2006 there is a new type of 401k contribution. Thats where our paycheck calculator comes in. Overall the New York Fed found the average reservation wage of the American worker has climbed to.

10 Steps To Make Sure You Have Enough Money To Retire The Retirement Manifesto Retirement Retirement Advice Money

Traditional Vs Roth Ira Calculator

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

What Is A Roth Ira And Do You Really Need One Adopting A Lifestyle Investing Investing Money Roth Ira

Roth Ira Conversion Calculator Converting An Ira Schwab Roth Ira Conversion Roth Ira Conversion Calculator

What You Need To Know About 401 K Loans Before You Take One

Here Is Where Your 401k Savings Vs Your Age Net Worth Good Work Ethic Personal Finance Blogs

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Net Worth Tracking Net Worth Calculator Investment Tracker Etsy Video Video Planner Inserts Printable Net Worth Planner Lettering

Debt Free With An Early 401k Withdrawal 401k Debt Debtpayoff Early Free Withdrawal Debt Payoff Plan Credit Card Debt Payoff Debt Free

How To Pay Down Your Debt Faster With The Debt Snowball Method Tdcj Debt Snowball Budgeting Money Budgeting

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Free 401k Calculator For Excel Calculate Your 401k Savings

401 K Calculator See What You Ll Have Saved Dqydj

How To Create A Debt Payoff Plan Debt Payoff Plan Budgeting Money Debt Snowball Worksheet

404 Page Cannot Be Found Paying Off Credit Cards Debt Snowball Debt Snowball Worksheet